Submitted by Jo Dickson on Tue, 16/02/2021 - 14:22

In this blog from Cambridge Centre for Housing and Planning Research (CCHPR), Hannah Holmes and Gemma Burgess, explain how they mapped the locations of over 350 UK businesses specialising in different types of OSM, including modular buildings, pods, panels, and steel and timber frames. They explore these geographies and their consequences for both the construction industry and government.

In the UK, calls have been made to increase uptake of off-site manufacture for construction (OSM). OSM includes modular units which are built offsite and then lifted into place, frames of timber or steel which are constructed elsewhere, and prefabricated components (such as bathrooms). These methods are regarded as a means of improving efficiency and productivity and accelerating digitisation in the construction industry in order to meet government housing construction goals.

While OSM has attracted a wave of government support and investment in recent years, there is remarkably little comprehensive evidence on the geographies of OSM and its impacts in different parts of the UK.

Pinpointing exactly where OSM occurs (from design, to construction, through to onsite assembly) matters: if the geographies of OSM are not fully understood, precisely who benefits or loses out, in which places, and in what ways, remains a hidden feature of the drive towards OSM in the policy agenda. Importantly, a lack of awareness of the geographies of OSM could place limitations on industry attempts to enhance sustainability and responsible procurement to the benefit of all regions of the UK.

The OSM market is rapidly changing, and research will be needed in order to understand future shifts. However, gaining an understanding of the implications of these geographies in the current production of OSM will provide opportunities for timely policy and industry responses. In the context of the government’s levelling up agenda, which aims to reduce regional inequalities in the UK, up to date understandings of the geographies of a key industry such as construction are of clear importance.

As a first step towards understanding the consequences of these geographies, it is pertinent to map the whereabouts of relevant companies. The industry is keen to understand these issues, and there have been recent industry efforts to do this, culminating in a mapped database of MMC manufacturers which was released by Kier and the Supply Chain Sustainability School, aiming to “make it as simple as possible for organisations to choose offsite”. The map already includes over 150 firms, and businesses are able to add themselves to the existing database.

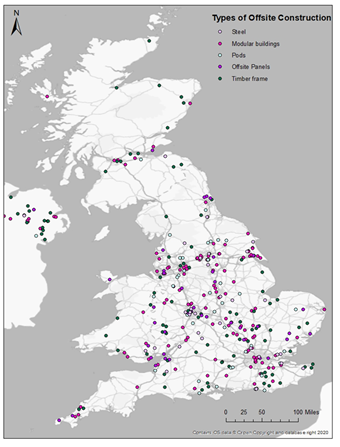

In order to provide a more detailed picture, we have mapped the locations of over 350 UK businesses specialising in different types of OSM, including modular buildings, pods, panels, and steel and timber frames. The map below draws on information from the Building Design Index, Construction.co.uk, The Construction Index, as well as further internet searches. There is no official comprehensive database of OSM firms, and so the map is not exhaustive in its representation of OSM in the UK. But it does indicate the broad geographies of this industry by depicting the locations of head offices or factories around the country (which are generally in line with the geographies depicted by the Kier database).

The map at the top of this page cannot show us where the components or modules delivered by these companies end up, nor does it provide any insights into the impacts of OSM for the communities affected. What it can do, however, is provide a starting point for thinking through some of the opportunities and challenges posed by the expansion of OSM.

Critically, the map shows that the spatial distribution of OSM companies is uneven. While the businesses mapped here are generally in close proximity to a motorway or an A road, there are vast areas of Scotland, Wales, and Northern England where very few of these firms exist. As the push for OSM accelerates, if the geography of this sector does not change, these areas may lose out as construction jobs and profits from building projects located in these places are diverted to the regions with a stronger OSM offering.

The potential implications of this for local economies are self-evident: the shift to such innovative techniques means that key wealth-generation activity is likely to be occurring in distant locations, and the local benefits of OSM compared with traditional construction – where builders are onsite and contributing to the local economy for months on end – are less clear. With the new Affordable Homes Programme requiring housing associations bidding for funding via Strategic Partnerships to deliver at least 25% of the housing using MMC, this uneven distribution is becoming an increasingly urgent issue. Such concerns are echoed in a House of Commons Housing, Communities and Local Government Committee report, which indicates that it is difficult to fulfil requirements to use local labour to deliver projects when large parts of the process are completed many miles away.

On the other hand, hypothetically, OSM could divert wealth production from construction projects in already wealthy areas to comparatively disadvantaged locations in the UK. As Kier states, mapping OSM and making a database of MMC manufacturers in the sector available to the industry provides an opportunity for project leaders to deliberately choose OSM firms in places which most need the associated economic benefits, with a view to reducing regional inequalities and enhancing employment opportunities in these areas. But unless a comprehensive evidence base is constructed to show exactly where such projects are located and the locations of the companies delivering them, the scale of the advantages of this opportunity will remain unproven. Further research is needed in order to establish the extent to which this approach to procurement occurs in practice, and its role in tackling spatial inequalities. Such work exploring the role that OSM could play in tackling regional imbalances may also help to identify the forms of support the industry may require in order to enhance their ability to undertake procurement with such considerations in mind. There is therefore a clear need for increased data collection, which will require collaboration and cooperation with industry partners.

There are also unanswered questions surrounding the implications of OSM for the geographies of the construction labour force. The skills required for OSM are not the same as those needed in traditional construction, and recent investments in skills training recognise this fact. This also has the implication that existing construction workforces in some areas may not currently be equipped to adapt to deliver such projects. Meanwhile, certain locations with existing skilled workforces in related industries are well-prepared, or have the potential to diversify: the significant cluster of OSM companies in Hull, which has long been a leader in the caravan industry and therefore already boasts a workforce with the kinds of skills and experience needed for OSM, is a case in point. These dynamics will warrant attention as the shift to offsite accelerates.

A further issue here is that there is no comprehensive database of the locations of projects using OSM. If there is a difference in uptake of construction innovations by developers constructing homes in disadvantaged areas compared to wealthier ones, this could have implications for existing inequalities. It is simply impossible to know the impacts of such construction methods (either positive or negative) on socio-economic inequalities across the UK without the systematic collection of data on where OSM and MMC more broadly are being used.

A new research project by the Cambridge Centre for Housing and Planning Research, in conjunction with the Construction Innovation Hub, seeks to place these questions around the geographies of inequality at the centre of considerations of OSM. The project will seek to address some of these issues, establishing the extent to which socioeconomic inequality stands to be affected by innovations in the construction industry, in terms of changes to the built environment, local employment, and wealth generation. The need to collect sufficient data on the emerging geographies of this industry shift in order to analyse not just the benefits, but the potential unintended outcomes of OSM in locations across the UK – and crucially, how such outcomes might be prevented – is clear.

This research forms part of the Centre for Digital Built Britain’s (CDBB) work at the University of Cambridge within the Construction Innovation Hub which brings together worldclass expertise from the Manufacturing Technology Centre (MTC), BRE and CDBB to transform the UK construction sector. The Construction Innovation Hub is funded by UK Research and Innovation through the Industrial Strategy Fund.

Contact: Dr Hannah Holmes and Dr Gemma Burgess